Unit construction in NSW collapses under tax burden for foreign investors

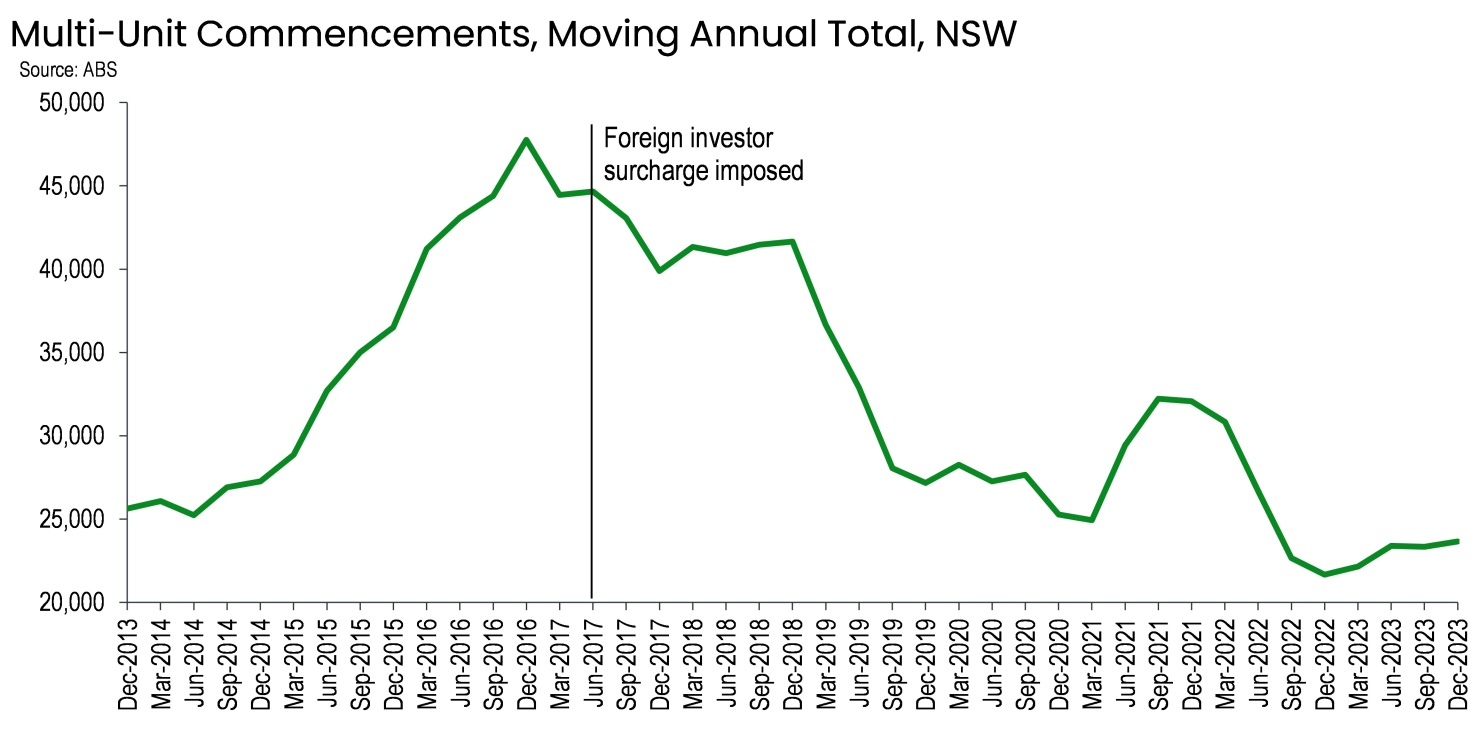

THE HOUSING Industry Association of Australia (HIA) has warned that residential unit construction has fallen by half in New South Wales since 2017, when new ‘foreign investor surcharge’ taxes were introduced by the State Government.

“Since the introduction of additional taxes in 2017, the number of units commencing construction in NSW has fallen by 50 percent,” HIA chief economist, Tim Reardon said.

“The number of apartments starting construction in NSW has fallen back to levels last seen in 2012, when the population of NSW was 1 million people fewer and migration was just one third the volume of 2023,” Mr Reardon said.

The Australian Bureau of Statistics (ABS) corroborated this in the release of its building activity data for the December Quarter 2023. This data provides estimates of the value of building work and number of dwellings commenced, completed and under construction across Australia and its states and territories.

“The more governments tax homes, the fewer homes will be built and the faster rents will increase,” Mr Reardon said.

“The Australian Government has stated a goal of building 1.2 million new homes. This ambitious target requires all states and territories to work toward this common goal.

“Making homes more expensive is not an effective policy response to achieve a slowing in migration to NSW.

“It will however lead to a more inequitable housing market with renters bearing the highest burden.

“There were only 23,653 multi-units that commenced construction in New South Wales in 2023, following just 21,652 in 2022. These were the two weakest years of apartment commencements since 2012,” Mr Reardon said

“The last two years of multi-units activity in NSW are less than half the 47,757 multi-units the state commenced in 2016.

“NSW introduced additional stamp duty and land tax surcharges on foreign investors from 2017. These taxes are in addition to those taxes, fees and charges imposed on foreign investors by the Australian Government.

“The result was an exodus of foreign investors and a dramatic decline in higher density home building. A similar outcome can be observed across the country, especially in the capital cities, where similar taxes have been imposed.

“Foreign investors are a crucial component to building new housing in Australia, especially the higher density living that is particularly important in periods of rapid migration.

“Foreign investors don’t live in these homes, and they cannot take them overseas and they are penalised if these homes are left vacant.

“The rapid population growth in NSW will not be slowed by increasing the taxes on home building,” he said

“Australian based institutional investors, who received a tax concession in the 2023 Federal Budget to invest in residential housing, are not filling the gap left by the withdrawal of overseas investors.

“At a time of record population growth and acute shortages of housing, NSW needs more of all types of homes with the support of investment from first home buyers, owner occupiers, government housing, domestic and foreign investors,” Mr Reardon said.

Check the HIA Stamp Duty Watch Report for more details.

ends