AUSTRALIA’s dairy sector may be the beneficiary of a new school milk program being implemented in Indonesia.

Food and agribusiness banking specialist Rabobank said the program, which is currently being rolled out across 400,000 schools in Indonesia, is part of the recently-elected Indonesian government’s Nutritious Meals Program, aimed to combat malnutrition and promote healthy eating among the country’s 60 million school children, as well as in pregnant women.

The school milk program is expected to significantly increase Indonesia’s total dairy consumption, creating opportunities for Australia and other global dairy players, according to a new report by Rabobank’s RaboResearch division.

In the report, Indonesia’s new school milk program could nourish minds and global dairy markets, Rabobank found the new Indonesian government has introduced a range of policy measures with the potential to transform the country’s dairy supply chain.

“The centrepiece is the Nutritious Meals Program, which aims to provide food, including milk, to 60 million students on every school day by 2029,” report author and RaboResearch senior analyst Michael Harvey said.

RaboResearch estimates the total milk required at full implementation could surpass 2 billion litres.

“This estimate is based on an anticipated 83 million recipients accounting for school absenteeism, lactose intolerance, and an average serving size between 125ml and 200ml,” Mr Harvey said.

The report says the school milk program has the potential to significantly increase Indonesian demand for liquid milk, both domestically produced and imported.

“The majority of milk consumed in Indonesia in 2024 was imported, with domestic production estimated at 900 million litres, and an additional 2.5 billion litres (liquid milk equivalent) imported,” Mr Harvey said.

Indonesia was Australia’s fourth largest dairy export market in 2023/24, after China and Japan, taking more than 60,000 tonnes of Australian product. Australia has also been a long-standing exporter of dairy cattle to Indonesia.

Local production to ramp up

To meet the growth in demand that will result from the program, the Indonesian Government’s dairy industry plan would significantly increase the national dairy herd, the report said.

As the rollout of the program gathers pace, investment across Indonesia’s dairy sector is expected to accelerate, Mr Harvey said, and this will also have pronounced impacts on the global sector.

“For Indonesia to achieve its ambitious milk supply growth targets and accommodate the considerable number of dairy cattle needed, it will need to scale up both live cattle supply and the local dairy supply chain,” Mr Harvey said.

“This will include need for feed genetics, farm infrastructure and farm management skills to support the expanding local industry. And overall, we expect global input players and dairy companies to benefit.”

Export opportunities for Australia

While the school milk program is likely to result in an increase in domestic milk supply and provide a tailwind for local Indonesian dairy players, Mr Harvey said, Indonesia’s dairy import demand was also expected to rise.

“Fundamentally, RaboResearch expects Indonesia to remain a net importer of dairy and anticipates that annual import volumes are likely to grow over the medium term.” he said.

The report said Indonesia was recognised as a high-growth dairy market compared with advanced economies, driven by its large population and rising disposable incomes.

“Even before the announcement of the school milk program, Indonesia was viewed as a dairy market with long-term high growth potential,” Mr Harvey said. “In a country with nearly 280 million people, the average per capita dairy consumption is around 15kg annually.

“Indonesia boasts a vibrant liquid milk market, which in 2024 was estimated at 1.1 billion litres, including both flavoured and white milk. And Indonesia faces a significant dairy import deficit as it strives to keep up demand.

Mr Harvey said “Australia plays an important role in Indonesia” and the new program could create opportunities to further lift dairy exports to Indonesia.

Mr Harvey said the new school milk program could also create additional live cattle export opportunities for Australia given Indonesia’s desire to expand its domestic dairy cattle herd.

“To meet the increased milk demand, the local milk supply would require a four-fold increase in the domestic Indonesian dairy herd, underpinned by the importation of more than one million dairy cattle from various countries over the next five years,” he said.

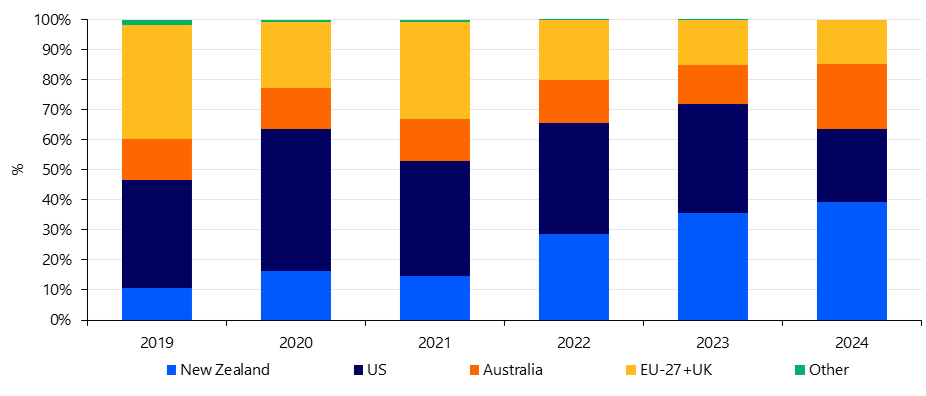

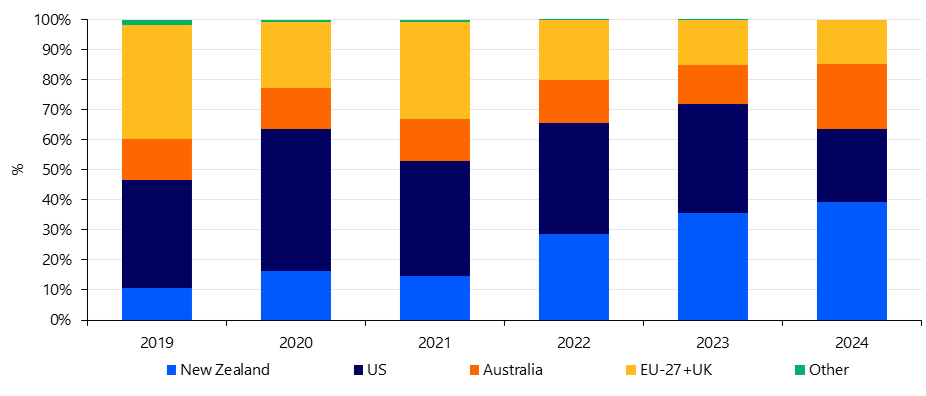

Mr Harvey said Australia has been a long-standing exporter of dairy cattle to Indonesia.

“According to Dairy Australia, between 2019 and 2023, Australia exported an average of 80,000 dairy cows each year, although with the vast majority going to China and only 7,500 destined for Indonesia,” he said.

However, Mr Harvey said, the timing of Indonesia’s current herd expansion was somewhat favourable, given “the softer Chinese demand for imported dairy heifers resulting in a surplus of heifers in Australia”.

Overall, Mr Harvey said, “clearly Indonesia is an important trading partner for Australian dairy and will continue to present growth opportunities moving forward”.

www.rabobank.com.au

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?