CLEAN technologies are providing their economic and community worth for a great many Brisbane business leaders – most engaging through the Brisbane CitySmart collaborative program – but there are a lot more gains and efficiencies to be had.

That is the headline message for the October 23 CitySmart Leaders Project lunch at Brisbane City Hall, which features insights by one of the global leaders in accelerating business and community outcomes through ‘cleantech’ collaboration.

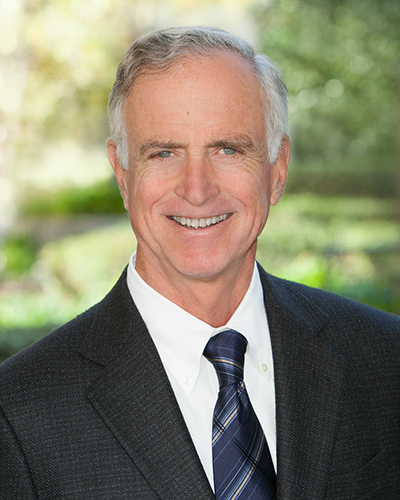

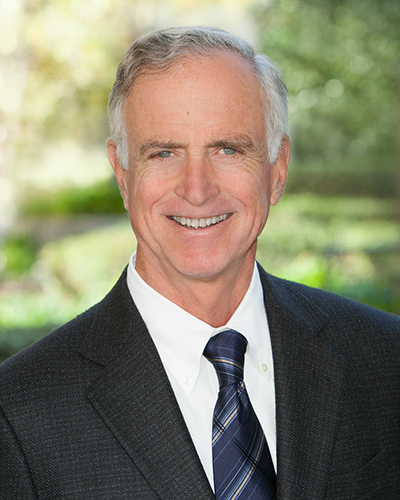

Jim Waring is Cleantech San Diego’s executive chairman and co-founder and he will outline to the Brisbane CitySmart event how the high adoption of cleantech systems and behaviours has not only transformed that city’s economic environment but also helped create a thriving new area of industry.

Mr Waring will explain how Brisbane – with some of the most innovative cleantech companies in the world – can adapt the experiences of San Diego to its own advantage. Through collaboration and leadership, the San Diego region has established itself as a global leader in the cleantech economy.

With more than 800 cleantech companies in the region, including over 300 innovator companies and more than 400 market enabler companies, San Diego’s diverse cluster of cleantech enterprises makes for a hotbed of innovation and investment.

Mr Waring’s Cleantech San Diego is an industry cluster association which works with government, industry groups, business and academia to incubate cleantech innovation and develop technology solutions at scale.

CitySmart, Brisbane City Council’s sustainability agency, operates through much the same principles and this CitySmart Leaders Project event hopes to inspire further business collaboration in cleantech from understanding where San Diego has taken its world-leading program.

Collaboration was the basis for Mr Waring founding Cleantech San Diego in alliance with the city’s mayor – ironically, as a result of being fired from his job as deputy chief operating officer for San Diego Land Use and Economic Development. He had gained that role as a result of his proven regional experience in real estate development and law.

“Through someone I had hired as a project consultant, I was introduced to our new mayor, Jerry Sanders. Jerry hired me and my title was deputy chief operating officer for Land Use and Economic Development,” Mr Waring said.

“Basically the development regulation, economic development team and real estate assets departments reported to me. I was there for 17 amazingly difficult and exciting months. I learned so much, and met many great people.

“I also learned that action and politics can often collide,” he said. “I was fired while vacationing in Iceland, which is a funny play on words. Seriously, it was a great experience that I would never trade.

“While there (in his San Deigo City role), I suggested to the mayor that the next opportunity in economic development would be developing a city and regional brand around business based sustainability,” Mr Waring said.

“Basically, striving to deliver goods and services in a sustainable manner and at a price normal people can afford. From this idea, and with the mayor’s support, we started Cleantech San Diego.

“At the time the idea of a clean technology based trade association was very novel. That was seven years ago.

“The field is so very different than I thought it would be.”

Mr Waring said he was glad to be able to impart as much as he could about what San Diego had learned to cities that are on similar paths, such as Brisbane.

“Generally, what we have learned is that it does make economic sense to do business in a sustainable manner,” Mr Waring said. “Baseline public policy is critical.

“Companies want to participate, but often don’t know how to do so efficiently.

“We have also learned that technology is way ahead of behaviours,” Mr Waring said. “And companies in America are way ahead of the political system.”

Brisbane’s CitySmart program may also benefit from San Diego’s experience in trying to drive more rapid and larger-scale change to business sustainability behaviours.

“It is much harder to scale projects involving many users than expected, primarily because the marginal individual benefits are not a motivator,” Mr Waring said.

“So we are focused on proving models that eliminate barriers and increase ease of adoption.”

The annual CitySmart Leaders Project explores the role of collaboration between industry, government, academia and the community in meeting market needs to drive sustainable economic development and innovation.

Mr Waring keynotes the October 23 luncheon event at Brisbane City Hall from noon. Members and non-members of CitySmart can attend.

http://www.citysmart.com.au/leaders-project-2014

ends