HIA outlook: Home building to rebound with interest rate cuts but long-term challenges remain

HOME CONSTRUCTION commencements across Australia are set to increase over the next few years, driven by strong population growth, low unemployment, and falling interest rates.

However, long-term structural issues continue to pose risks to housing affordability and national supply targets, according to the latest outlook from the Housing Industry Association.

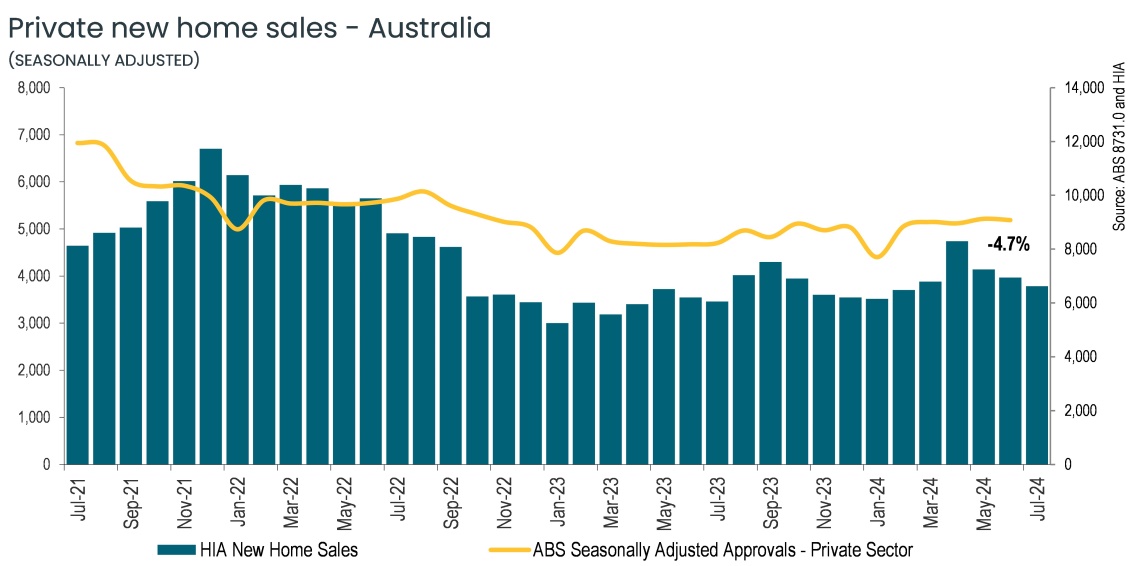

HIA chief economist Tim Reardon said the sector is showing signs of improved confidence following a period of weak activity, particularly in apartment construction.

“We expect new home commencements to increase steadily through the second half of the decade,” Mr Reardon said.

“Detached house building will lead this recovery, peaking in 2027, with apartment construction set to follow as market conditions and policy settings improve.”

Recent interest rate cuts and historically strong migration are adding to demand for new housing, he said. But ongoing constraints including land shortages, regulations and taxes are increasing the cost of construction and limiting supply. This would continue to drive up the cost of both renting and buying a home.

“The only way to close the growing gap between supply and demand is through meaningful reform—particularly at the state level,” Mr Reardon said.

Building to fall 20% short

The HIA report forecasts that home building will fall 20 percent short of the Australian Government’s target of 1.2 million new homes over the five years.

“We need to unlock land, streamline planning processes, and remove barriers to investment if we are to meet the housing needs of a growing population,” Mr Reardon said.

“Australia has the capacity to deliver, but it will take a coordinated response from all three tiers of government to overcome these constraints.”

While detached housing is showing strong growth in Western Australia, South Australia, and Queensland, activity remains subdued in New South Wales and Victoria.

Apartment construction is yet to recover from a collapse in foreign capital caused by punitive state taxes and is expected to rebuild gradually towards the end of the decade. This growth will be boosted by ongoing demand from migration and Olympic focused building in Brisbane.

“Housing demand is not going to decline with a rise in interest rates,” Mr Reardon said.

“It is continuing to grow along with the population. Structural reforms are needed now to shape affordability, economic opportunity and living standards for the next generation.”

HIA’s outlook on housing construction markets

Detached houses: There were 26,880 detached houses that commenced construction in the December quarter 2024, which brought the 2024 calendar year to 107,240 detached starts, up by 7.0% compared with the previous year. This increase is expected to continue with a further 3.7% in 2025 to 111,240, and 6.7% increase 2026 to 118,660 and to a peak in 2027 of 120,910 starts. Detached starts are then expected to fall as the cost of land and rising borrowing and construction costs see households shift demand to unit construction, seeing starts fall to 108,240 in 2030.

Multi-unit dwellings: There were 15,390 multi-unit dwellings that commenced construction in the December quarter 2024, which brought the 2024 calendar year to 60,940 multi-unit starts, the lowest in 13 years. This is expected to be the trough of this cycle with the number of multi-unit starts increasing to 68,850 in 2025. A further 9.6% increase in 2026 will still see multi-unit commencements remain anaemically low at 75,450. From this point, capacity constraints should ease, while demand continues to exceed supply, resulting in an additional 13.0% increase in starts in 2027 to 85,250. This expansion should continue and exceed 100,000 starts in 2029 for the first time since 2018. From this point, the increase in multi-unit starts will ease.

Click here to purchase HIA State and National Outlooks

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?