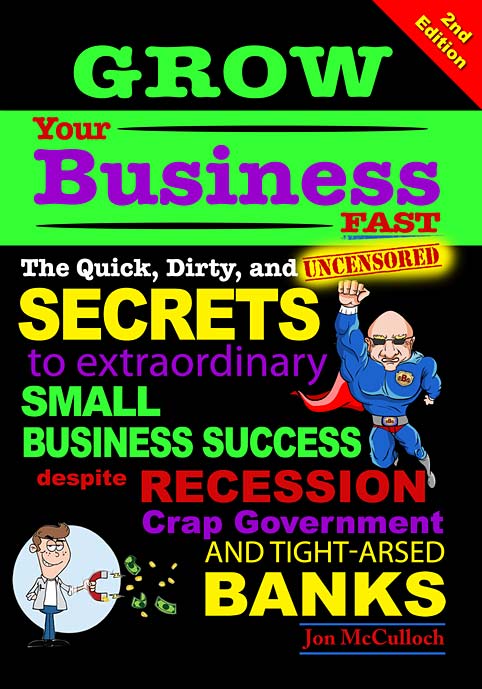

BS-free guide Grow Your Business released by ‘Evil Bald Genius’

ITS MAIN title is Grow Your Business FAST – but the subtitle tells it like it is: 'The Quick, Dirty, and Uncensored Secrets to Extraordinary Small Business Success Despite Recession, Crap Governments and Tight-arsed Banks’.

It is the work of UK-based copywriter and web marketeer Jon McCulloch, who happily admits he is “an unlikely genius and small business advocate who stops at nothing to make sure savvy and open-minded business owners know the truth”.

Mr McCulloch’s goal is to help readers work less, earn more and build their own empires – but those stepping up to the plate must have a hard exterior. Mr McCulloch is as intense and unorthodox as they come.

The information his publishing company has released on this book gives a fair indication of what the prospective reader is in for.

“Those engaging with a business growth consultant would likely imagine a suit-clad gentleman with the perfect side parting and lack of social skills to match. Stop right there; Jon McCulloch is a celebrated and renowned consultant, but he’s so unconventional in appearance and approach that he’s come to be known as the Evil Bald Genius.”

Grow Your Business FAST: The Quick, Dirty, and Uncensored Secrets to Extraordinary Small Business Success Despite Recession Crap Governments and Tight-arsed Banks will make readers very uncomfortable, but for good reason. Mr McCulloch knows the truth about growing any business, and the truth hurts.

Jon McCulloch’s scathing and uncompromising style and language are for neither the sensitive nor the faint-hearted. He claims that in Grow Your Business FAST there’s something guaranteed to offend everyone.

But that’s okay, he asserts, because he is not in the business of winning friends and influencing people – and certainly not if it comes at the expense of hiding or obfuscating the truth about what it takes to succeed legally, morally, ethically, and entirely above board in business in today’s dire economy, “despite recession, crap government, and tight-arsed banks”.

“So if you're looking to have your hand held and your fevered brow mopped with gentle, loving hands, you’d be best advised not to read this book, because you won’t like it,” Mr McCulloch said.

“I can be your best business friend, but your worst personal nightmare.

“Each of my strategies is proven and ‘battle-tested’ in the real world, but I’m not going to tread on eggshells just to make you feel good while delivering them. Look, your business skills likely suck and you have a growth strategy as useful as a one-legged man in an arse kicking competition. But it’s okay, I’ll help you change it.”

“It is possible to make more money with less work and fewer headaches; just don’t expect it to be easy. This is the complete blueprint that will see your bottom-line skyrocket in just three months. But, damn, I don’t even know why I wrote it sometimes – 99 percent of business owners I meet are too lazy to even deserve this kind of information.”

Evil Bald Genius Jon McCulloch may live in West Cork, Ireland – “with Mrs EBG, his Jack Russell Terrier, Haggis, and an assortment of other dogs and cats” – but he has a global client base for his primary business as a copywriter and marketing consultant. In fact, he calls himself “the most expensive copywriter and marketing consultant in Europe, as far as I know”.

He is regarded as one of Europe’s leading educators in direct response marketing and meets the needs of a fixed private client list, claiming to rarely open up to new clients because the ones on his list “never leave”.

When not busy writing inflammatory business books to assist business owners find their way, he claims to spend most of his time reading, writing, riding his bike, pumping iron, and growing the businesses of his 26, £997-a-month Elite Mastermind Members.

Sounds like he does not need those tight-arsed banks himself these days.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?