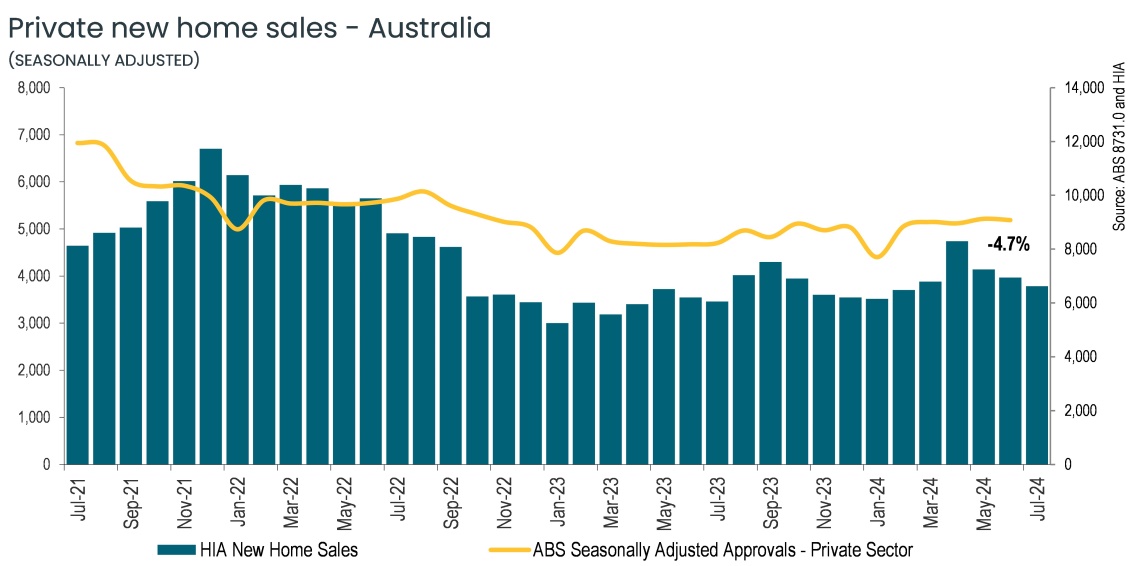

HIA economist says building approvals were up for 2024-25

“NEW home building approvals in the 2024/25 financial year were up by 13.9 percent compared with their 2023/24 trough,” Housing Industry Association (HIA) senior economist Tom Devitt outlined as part of his recent market assessment.

The Australian Bureau of Statistics has just released its monthly building approvals data for June 2025 for detached houses and multi-units covering all states and territories.

“Detached house approvals increased by 6.1% in the financial year, while multi-unit approvals were up by 27.9%,” Mr Devitt said.

“Strong population growth, tight labour markets and recovering household incomes helped improve confidence in an increasing number of markets over the last 18 months, led by Western Australia, Queensland and South Australia.

“Interest rate cuts from the Reserve Bank in February and May this year, with the expectation of more to come, will help bring more potential homebuyers back to the market in the lagging – and often more expensive – states and territories.

“The challenge will be turning this modest improvement in conditions into the kind of recovery that will meet the Australian Government target of 1.2 million homes over five years," Mr Devitt said.

“In the 2024/25 financial year, the first year of the government’s five year target, Australia approved just 187,330 new homes. Given that some approved projects don’t ever commence construction, the goal of commencing 240,000 homes per year remains a distant goal.

“Even with lower interest rates, Australia is set to start just 200,000 homes per year, on average, over the next four years.

“Multi-unit activity, in particular, needs to do more heavy lifting. Multi-unit commencements need to double from current levels in order to achieve the government’s housing targets.

“This is unlikely to occur under current policies. Labour and land shortages, obstructionist regulations and punitive surcharges on institutional investors have pushed improving sentiment away from apartments back into the detached housing sector.

“Sustained improvement in multi-units activity will need to come from a reduction in policy burdens on the sector, or a re-acceleration of home prices until new projects are viable against higher policy costs, the latter not boding well for affordability,” Mr Devitt said.

Total new dwelling approvals in the 2024/25 financial year, in seasonally adjusted terms, increased in Western Australia by 32.3% and South Australia by 28.7%, followed by New South Wales (+16%), Queensland (+13.1%) and Victoria (+9.1%).

Tasmania declined by 9.9% In original terms, the Northern Territory increased by 22.5% while the Australian Capital Territory declined by 39.9%.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?  said the Joint Group of Industry Associations has outlined four priority areas to boost Australia’s economy ranging from the practical to the ambitious.

said the Joint Group of Industry Associations has outlined four priority areas to boost Australia’s economy ranging from the practical to the ambitious.