Australia’s ageing population: Pressure that’s only set to rise…

By Dan Hadley >>

AUSTRALIA’s population is ageing. Older Australians are a growing proportion of the total population, year-on-year. For business leaders, it is important to understand the ramifications.

According to the Federal Government’s Australia’s Ageing Population Report, released in 2019, the growth in the proportion of older Australians is partly due to an increase in life expectancy.

In the 1960s a man might have expected to live an average life span of 78 years and a woman 78 years. Today the average life expectancy is around 85 for men and 87 for women in Australia. Some experts believe that the average life expectancy will continue to rise over time.

Australians enjoy one of the highest average life expectancy rates in the world. The CIA World Index lists Monaco as having the greatest average life expectancy of its citizens at over 89 years and the lowest being Chad at just over 50 years.

The Parliamentary Budget Office recently issued its Australia’s Ageing Population Report for 2019, subtitled Understanding the Fiscal Impacts Over the Next Decade 02/2019. In it, the government addresses the effect an ageing population has on the Federal Budget.

While an ageing population is a slow process, it does represent a rise in financial costs over time. Additionally, it can – and certainly does for Australia – represent a reduction in workforce participation rates.

WHO IS WORKING, WHO IS NOT?

Workforce participation rate represents the section of working population, aged between 15 and 65, in the Australian economy currently employed or seeking employment. Essentially, it refers to the total number of people or individuals working right now or in active search of a job.

Australia is currently going through a particularly significant phase of demographic change. The ratio of aged dependents to working labour participants continues to trend closer and closer to a smaller ratio.

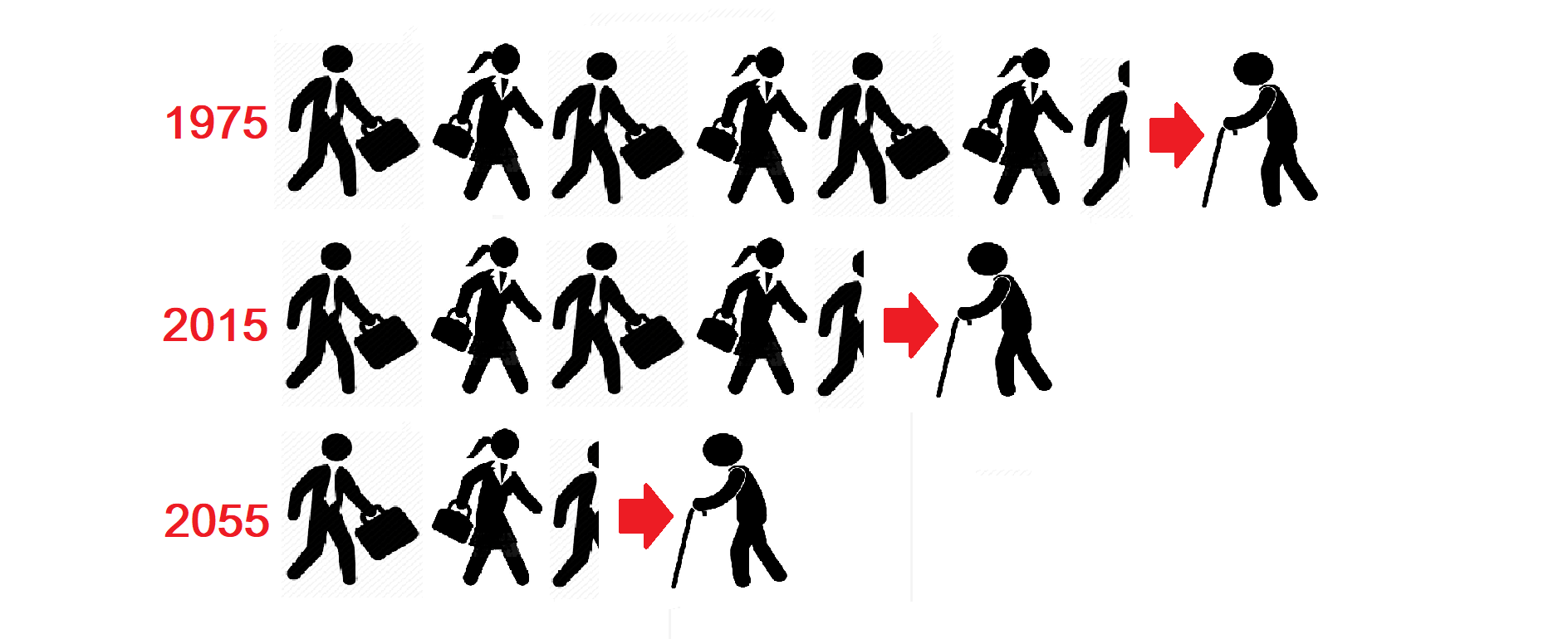

In simple terms, this means there are fewer and fewer workers over time to contribute to the economy. The movement of the baby boomer generation to retirement age is already reducing labor force participation and increasing the take-up of the Age Pension. In 1975, the ratio of workers to aged dependents was almost 7:1. Today it is around 4.5:1 and the Parliamentary Budget Office projects this ratio to fall to around 2.5:1 by 2055.

This double-edged sword, consisting of an increase in spending (such as greater Age Pension spending) and a decrease in national tax revenue (primarily reduced income tax collection) means a hefty level of pressure on the economy and those working.

The rising number of dependent aged citizens in Australia require publicly funded services such as accommodation, health care, social service payments and transportation. The economy may end up struggling to provide these goods and services in sufficient measure.

The economy may also struggle to find skilled labour for roles or jobs within the aged care sector, such as nursing or other medical jobs. Such a reduced available labour market may further raise wages, leading to an increased cost of living for the elderly and, thus, a greater pressure on taxpayers.

FEDERAL GOVT’S OPTIONS

Australia’s Federal Government has an ever slowly approaching issue on its hands.

There are a number of options to consider or strategies to implement to try to address the issue, some of which have already been put into effect to some extent.

In short, some of the key fiscal strategies available include:

- Increase the retirement age. This has already been implemented in Australia with a tiered roll out raising the retirement age to 67 in stages up until 2023 when it is set to remain at 67. This strategy increases the workforce participation rate for a longer period per citizen and slows the entry onto Aged Pension payments. This also has the effect of reducing the average time the pension is paid out.

- Increase taxes. Not a popular decision for any government but possibly a logical one. Increased taxes may raise greater federal revenue in order to cover the increasing cost of living for aged/retired citizens. This strategy decreases the propensity or desire to work though, can stimulate a reduction in migrant worker population and foster a greater level of Australian worker exoduses to other countries as Australian professionals may seek more competitive employment options overseas.

- Freeze or reduce Age Pension payments and other services. Largely considered as an unviable option, this strategy would ultimately lead to a lower quality of living for those aged or retired citizens in Australia.

- Stimulate employment. This can be done by several means including employment placement programs, incentives for employers and educational programs. Ultimately if fewer people are unemployed this will have the effect of pushing the participation rate back towards more sustainable ratios.

THE ROAD AHEAD

The Federal Government’s 2015 Intergenerational Report presented the impact of the ageing population over the next 40 years (from 2015).

This Parliamentary Budget Office (PBO) report uses a broadly comparable approach to quantify the impact of demographic change on the federal fiscal budget over coming years.

There are difficult choices to make for the current government and those future governments that follow.

With an already existing strain on health resources and the hospital system, Australia will need to find a way to balance those citizens working against those that have moved into retirement.

Dan Hadley is a British/Australian economist and business management consultant for JLB based in Adelaide, South Australia.

How to resolve AdBlock issue?

How to resolve AdBlock issue?