Finder economic survey: two-thirds predict end of stamp duty by 2021

THE MAJORITY of experts consulted in the latest Finder RBA Cash Rate Survey agree that stamp duty could soon be on its way out as the government grapples with the post-COVID economy.

Comparison site Finder’s survey – the largest of its kind in Australia – asked 43 experts and economists about future cash rate moves and other issues related to the state of the Australian economy.

While all experts surveyed expect a cash rate hold in June (43/43), more than two-thirds who weighed in on stamp duty (69%, 24/35) predicted that it would be axed within the next 18 months, with most (21) expecting the change in 2021.

Policymakers have been calling for an overhaul of taxes to help boost the post-COVID economy, with stamp duty emerging as the most ripe for reform.

Graham Cooke, insights manager at Finder, said stamp duty heavily penalises families who were required to move regularly for work, as well as those trying to get on the property ladder.

“Stamp duty makes the process of buying a home even harder,” Mr Cooke said.

“Not only do borrowers have to save a 20 percent deposit, they also need to save well over $10,000 – in some cases more than $80,000 – for a tax that generally cannot be included in your mortgage.

“It’s like an on-the-spot fine for home buyers. Putting this tax burden all up front, holds back purchases and dissuades buyers from purchasing frequently,” Mr Cooke said.

Not only do economists think stamp duty will be axed, four in five (80%, 28/35) also think the tax should be abolished or replaced with a land tax.

Mr Cooke said eliminating stamp duty or replacing it with an ongoing land tax could be a great way to stimulate the market.

“As a borrower, investing that $10k-$80k in the value of your home rather than immediately losing it to the government will be a huge benefit,” he said.

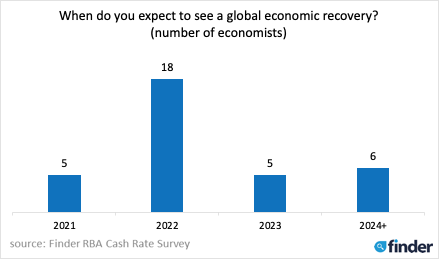

ECONOMIC RECOVERY WHEN?

More than four-fifths of experts (29/34, 85%) said the economy would not fully recover until at least 2022.

More than one-third of experts (37%, 14/38) expected Australia to have its first quarter of GDP growth in Q3 2020.

Mark Crosby, applied macroeconomist at Monash University, said Q3 GDP growth is more about how bad the preceding quarters have been.

“If growth in Q3 2020 was measured against any quarter in 2019 it would be negative,” Mr Crosby said.

“In other words it’s growth but nowhere near a reversion towards trend in Q3, not the end of recession (other than in definition) and not the end of rising unemployment,” he said.

RESTAURANTS STRUGGLE INTO 2021

Mr Crooke said those anxious for a ‘normal’ restaurant experience once restrictions ease, may be waiting longer than they think.

Nearly half (47%, 15/31) of the experts who weighed in on hospitality said restaurants and bars won’t be operating at full capacity and without social distancing restrictions until 2021.

Less than a third (10, 31%) expected to see this happening this year.

Mr Cooke said while restrictions were beginning to be relaxed, Australia still had a way to go until things return to normal.

“While restrictions are beginning to ease, it’s clear we’re still a long way off from booking a big group table at the pub over the long weekend,” Mr Cooke said.

EXPERT OPINIONS

Nicholas Frappell, ABC Bullion: “The impact of coronavirus will create a lasting demand impact and rates will stay low for an extended period of time. The RBA is likely to target longer-term bond yields in preference to negative rates.”

Shane Oliver, AMP Capital: “The cash rate is already at the RBA’s effective lower bound and Governor Lowe has reiterated that negative interest rates are ‘extraordinarily unlikely’ so, rates won’t be cut. But with the economy taking a big hit from the coronavirus shutdown, economic activity has fallen well below potential, and this will take a long time to fully reverse which means high unemployment and low inflation for several years to come so the RBA can’t raise rates. We don’t expect the cash rate to start increasing again for three years at least.”

Alison Booth, ANU: “The economic indicators suggest a rate cut in near future, but the timing is uncertain. Unemployment is increasing, participation and hours of work are declining, investment and household consumption will continue to be declining. Lowering interest rates may encourage people to spend more though the amount rates can drop is very curtailed and any effect would be very marginal.”

John Hewson, ANU: “RBA will hold for a couple of years, but bond selling task may start to force market rates up.”

Malcolm Wood, Baillieu: “RBA forward guidance and zero global rates.”

Rebecca Cassells, Bankwest Curtin Economics Centre: “The RBA won't increase the interest rate until we see strong signs of economic recovery – this may be some years away. Until then, they will keep the cost of borrowing as low as possible.”

David Robertson, Bendigo and Adelaide Bank: “No further cuts needed – we are on our effective floor for interest rates. The next increase is several years away when employment reverts to pre COVID-19 levels.”

Sarah Hunter, BIS Oxford Economics: “I don't think the cash rate will rise until 2023 (so, I'm not really unsure) – the recovery from COVID-19 will have a long tail, and the RBA will be looking to support the economy throughout.”

Ben Udy, Capital Economics: “To be clear, I'm not unsure of the timing. I think the RBA will remain on hold until beyond 2022.”

Peter Boehm, CLSA Premium: “Still unclear how long it will take to get a line of sight on where the economy is heading – I can't see rates increasing for the foreseeable future, especially with potential recessionary pressures on the horizon.”

Saul Eslake, Corinna Economic Advisory: “You didn't have an option for later than Q4 2022, otherwise, I might have chosen that. The RBA has repeatedly stated, since its March meeting, that it will keep the cash rate at its present level until sustainable progress is being made towards the inflation target and full employment – and I suspect it may not be until the second half of 2022 that those criteria are satisfied.”

Craig Emerson, Craig Emerson Economics: “No one can predict the course of a global pandemic and its economic impacts.”

Trent Wiltshire, Domain: “The RBA will keep the cash rate unchanged for at least the next two years as the unemployment and underemployment rate will remain elevated for an extended period due to the COVID-19 recession.”

John Rolfe, Elders Home Loans: “I do not think the RBA will lower the cash rate any further. There would be no benefit to anyone other than the banks and they are in a strong position. I believe the next rate will be up – perhaps as early as at the end of Q1 2021 if there is no second wave of COVID-19 in Australia.”

Angela Jackson, Equity Economics: “The RBA will hold cash rates until the economy recovers and unemployment is around the 8 percent mark. Uncertainty around the path of COVID-19 makes predictions on when this occurs difficult. Best case scenario third or fourth quarter of 2020-2021.”

Mark Brimble, Griffith University: “The current situation will need to play out further before a direction is clear. Either way, it is likely to be lower for much longer.”

Tony Makin, Griffith University: “The official interest rate has apparently reached its floor level. The main story now is the quantum of government bonds the RBA has been buying as a result of the COVID-19-related spike in the budget deficit. Textbook monetary economics tells us this increases the money supply accordingly. Central banks around the world are doing likewise. Whether this means a subsequent and unexpected global inflation surge remains to be seen. But history shows it could happen after a lag of several years.”

Stephen Miller, GSFM: “I do not think the RBA wants to cut the cash rate further. Any easing of monetary policy will take a different form.”

Peter Haller, Heritage Bank: “The RBA has made it clear that the cash rate will be at 0.25 percent for an extended period of time.”

Leanne Pilkington, Laing-Simmons: “The RBA has stated its view that rates are at their lowest point, and there’s no appetite for negative rates. The banks themselves have access to cheap credit at the moment, which is reflected in the low rates charged to customers. The economy remains in a fragile place and while some businesses cautiously re-open, we see the holding pattern continuing for the foreseeable future.”

Nicholas Gruen, Lateral Economics: “They should cut to zero (no reason not to), but they’ve said they won't.”

Mathew Tiller, LJ Hooker: “The RBA is unlikely to drop rates further and is expected to continue to support the economy via its other stimulatory measures.”

Geoffrey Kingston, Macquarie University: “Inflation could be picking up at this point.”

Jeffrey Sheen, Macquarie University: “The economy should have recovered sufficiently in two years.”

Stephen Koukoulas, Market Economics: “The fall-out from the health crisis is still unfolding. It is not possible to be confident about monetary policy pressures until that is resolved.”

John Caelli, ME Bank: “The RBA will keep the cash rate unchanged for an extended period of time until the full impacts of COVID-19 are known.”

Michael Yardney, Metropole Property Strategists: “We are now in the low-interest-rate environment for at least three years, the RBA doesn’t want to spook the market with negative interest rates.”

Mark Crosby, Monash University: “Further rate cuts are likely to have no effect, and I think it will be a while before a full recovery from COVID-19 leads to increasing rates – in other words, the RBA is likely to do nothing on rates until 2022.”

Julia Newbould, Money: “Depending on what other stimuli are employed, it might be time to raise the rates by then.”

Susan Mitchell, Mortgage Choice: “I expect the Reserve Bank to hold the cash rate at its monetary policy meeting in June. RBA board members seem resolute in their mission to support the economy as they target full employment and the inflation target. April Labour Force data from the Australian Bureau of Statistics shows that this goal will not be achieved in the near-term, with a tragic loss of employment over the month. That being said, April Payroll data from the ABS provided a glimmer of hope that the deterioration may not continue into May. While social distancing rules had a detrimental effect on property sales, data from CoreLogic shows that the loosening of restrictions has seen volumes lift again, which may be bolstered by an extremely low cost of borrowing for the foreseeable future.”

Dr Andrew Wilson, My Housing Market: “Rate to remain steady for foreseeable future. Contemporary, effective monetary policy set to go the way of the dinosaurs.”

Andrew Reeve-Parker, NW Advice: “Interest rates are at historic lows at the moment, but by 2022, I expect the economy to be running ahead of trend."

Rich Harvey, Propertybuyer: "COVID-19 has placed policymakers in a very difficult situation. RBA has already indicated they will not go to negative interest rates and there is little impact reducing a further 0.25 percent.”

Matthew Peter, QIC: “The RBA and other global central banks will keep rates at their lower bound for some years to come. It is unlikely that we will see a rise in policy rates within the coming four years.”

Noel Whittaker, QUT: “No way they were increasing them – and it’s pointless to drop them. There are too many uncertainties to make any kind of forecast – I am pessimistic.”

Cameron Kusher, REA Group: “They have stated that there will be no increase in the cash rate until unemployment is on its way to full employment and they are comfortable inflation will be within 2-3 percent. That looks a long way off. They also seem extremely reluctant to take the cash rate any lower than it currently is.”

Sveta Angelopoulos, RMIT university: “The RBA is unlikely to change the cash rate until the economy is well into recovery and even then, only if it feels, it is overheating.”

Christine Williams, Smarter Property Investing Pty Ltd: “Given the medical and financial climate we are in, I believe rates will be kept on hold.”

Janu Chan, St George Bank: “RBA is unlikely to move the cash rate any time soon. It sees the cash rate at its effective lower bound, and for the cash rate to increase, we would need to see a very meaningful decline in unemployment. Spare capacity in the labour market will remain for some time.”

Besa Deda, St.George Economics: “The RBA has indicated that it will not raise the cash rate before removing the 3-year bond yield target. It will take time for the unconventional policies to be unwound, and these will only be unwound once the economy recovers which is not expected until later this year and next.”

Mala Raghavan, University of Tasmania: “Due to the uncertain times ahead and the worldwide ability to contain the pandemic, it will be difficult to predict the effectiveness of an accommodative monetary policy (irrespective of conventional or unconventional measures). What is probably needed for the way forward, is a well-coordinated fiscal and monetary policy measures - first, the focus should be on containing the health crisis, and then subsequently the focus should be on stimulating the economy.”

Other participants: Bill Evans, Westpac. Jason Azzopardi, Resimac.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?