By Dan Hadley >>

JULY of this year saw the Reserve Bank cut interest rates again by another 0.25 percent. While this spells an immediate celebration for homeowners and investors keeping up with mortgage payments, other factors are at play.

Banks’ failures to pass on the full saving, in an attempt to increase profits, gives rise to consumer frustration and the rising cost of imports.

The landscape looks brighter for some, while tougher for others and there is a slowly rising concern over Australia’s slowing economy.

HOW DOES THE RBA AFFECT INTEREST RATES?

This is what economists call ‘Monetary Policy’. In short, the Reserve Bank of Australia (RBA) engages in transactions in domestic money markets.

These transactions resemble auctions with commercial banks who intend to buy or sell cash. They follow public announcements (to all banks) that the central bank intends to make such transactions.

The price a commercial bank is willing to pay for cash determines who is successful in obtaining cash. Referred to as Open Market Operations, this ‘toing and froing’ of money effects how much cash is out there in the economy.

The more money available in the economy, the lower the interest rate.

PICKING UP A FREE BONUS

When the RBA cuts interest rates, consumers expect that the banks they deal with will follow suit and pass on the rate reduction. Any difference in the RBA rate cut and what banks pass on to their customers is an easy win for the banks.

Those consumers not aware of the RBA rate cut amount may see a reduction in their mortgage interest rate, albeit a lower one than otherwise possible, as a win.

In the last week, banks announced how much of the interest rate cut will be passed on to customers and the landscape for the ‘Big 4’ banks now looks like this:

|

Banks

|

Interest Rate Reduction

|

Variance from RBA cut

|

| Commonwealth |

0.19%

|

0.06%

|

| NAB |

0.19%

|

0.06%

|

| Westpac |

0.20%

|

0.05%

|

| ANZ |

0.25%

|

0.00%

|

The ‘Big 4’ Banks and their respective interest rate reductions to customers

With this in mind, Australians are feeling more let down by banks than ever.

One of the difficulties is the cost and difficulty involved in changing banks for mortgage loans. The amount of paperwork required, since the Royal Commission, coupled with mortgage fees of all kinds makes it hard for consumers to vote with their feet easily.

Banks have certainly given consumers the impression that they are aware of this and have no difficulty taking advantage of it.

Australian Treasurer Josh Frydenberg said the Australian Government “…expects all banks to pass on the benefits of sustained reductions in funding costs.”

Even though ANZ Bank quickly announced it would pass on the full 0.25 percent cut to its customers, this follows a mere 0.18 percent pass on in June when the RBA previously cut interest by 0.25 percent.

This recent announcement may represent ANZ’s response to angry customers not happy with June’s profit pocketing.

OTHER WINNERS AND LOSERS

Interest rates influence more than just mortgage payments. Every movement affects industries and sectors in different ways.

One of the big winners is the building and construction sector. As individuals and businesses are able to borrow money more easily and borrow more than they previously could have, investment into new building, construction and property development naturally increases.

Builders will see an increase in demand for both existing property renovations as well as new builds.

Another key winner is the mining export sector. As interest rates fall, so does the value of the Australian dollar relative to other currencies. This makes exports of any kind, particularly minerals, cheaper to foreign buyers and thus more competitive.

Other exports such as manufactured products and produce becomes more attractive to export as the price drops immediately in the face of RBA cuts.

Australia can also expect to see a stimulus in the tourism industry. All of a sudden, it is cheaper for foreigners to visit Australia and enjoy all that we have to offer. This comes as good news to regional Australian areas dependent on tourism numbers.

But with the good news comes the bad. As our Australian dollar drops in value, anything imported costs more as our dollar has a lower purchasing power. Fuel is expected to rise in price which in and of itself affects the price of many other goods and services. Imported electrical goods and vehicles are expected to rise in price amongst anything else imported into Australia.

Australians can also expect to see new car sale prices increase, overseas travel to be more expensive and foreign items be dearer in the face of interest rate cuts. Affected too, are those with their funds in savings accounts, the return on investment now dropping again. This can ultimately hurt older Australians who may be reliant upon this form of investment and return in retirement.

THE RBA’S POSITION

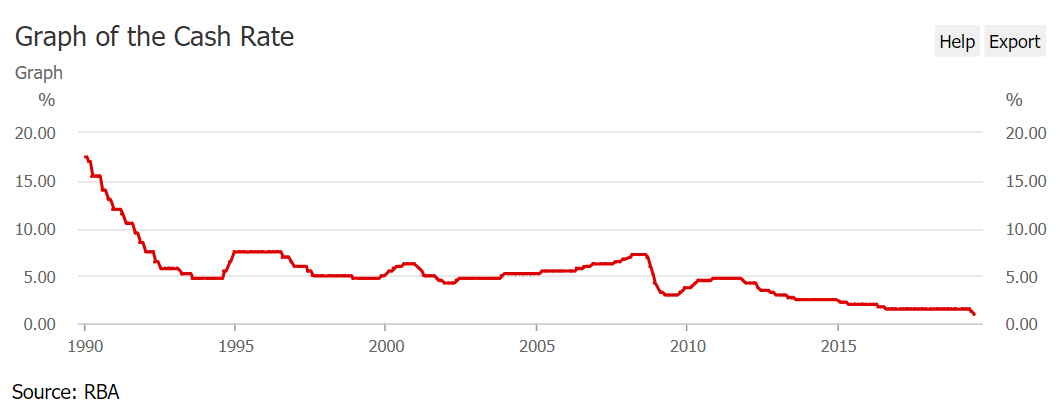

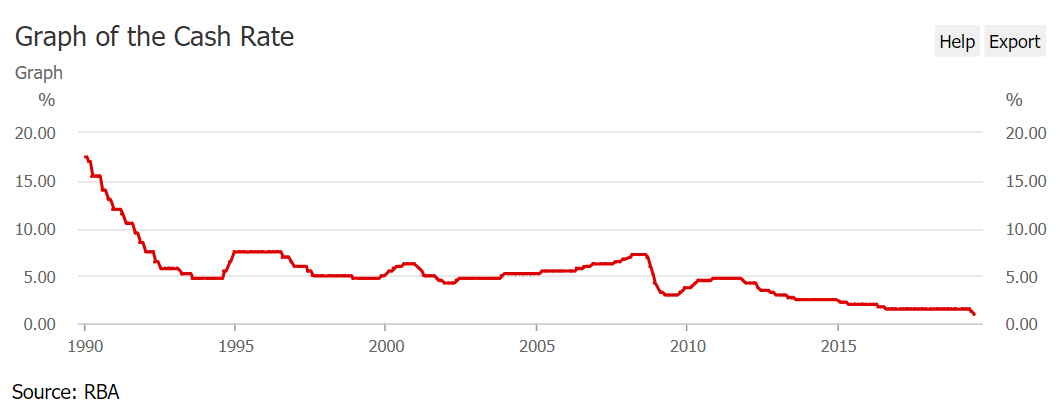

The RBA has had a steady downward trend in interest rates now since 1990. It is clear that in the face of various economic challenges the need has arisen to push the interest rate lower and lower to maintain certain key parameters.

RBA’s Governor, Philip Lowe said the recent decision to cut the rate would serve to:

“…lower the cash rate (that) will help make further inroads into the spare capacity in the economy. It will assist with faster progress in reducing unemployment and achieve more assured progress towards the inflation target.”

The cut comes just one month after the RBA’s decision in June to cut the interest rate by 0.25 percent then. This back to back cut in interest has not been seen in Australia since 2012.

MORE INTEREST RATE CUTS TO COME?

Lowe’s statement has given Australians strong indications that further cuts are very likely in the quest to achieve a lower unemployment rate. As interest rates drop, generally speaking, so too does unemployment.

The government has made it clear that an unemployment rate of 4.5 percent is the intended outcome.

With a current rate of 5.2 percent there is more to be done.

With more cuts likely on the horizon, homeowners and investors can get a little more back in their pockets but those savings may be gobbled up when they next travel, stop in to get fuel or purchase that new imported European luxury car…

Dan Hadley is a British/Australian economist and business management consultant for JLB based in Adelaide, South Australia. www.jlb.com.au

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?