Netwealth, AdviserNETgain, Lonsec lauded by financial advisers

RESEARCH by Adviser Ratings has found financial advisers are highly dissatisfied with major incumbent technology vendors – although they rate Netwealth, AdviserNETgain and Lonsec highly.

“Technology and investment research providers to financial advisers are on notice to better serve their clients.” Adviser Ratings, managing director Angus Woods said. “Our survey clearly shows a high level of dissatisfaction with many technology players, at a time when advisers are facing other cost pressures, particularly in the areas of education and compliance.

“Advisers are looking for more technological and phone support from platforms and planning software to free up their time and provide compliant end-to-end solutions to achieve this. In addition, with increased adviser mobility between licensees and the growth in social media, advisers are becoming more influenced by their peers’ opinion when selecting a new platform or software solution.”

It was no wonder major incumbent providers that previously drove the market for financial advisers – particularly the ‘Big Six’ of AMP, IOOF and the banks – were very much on the outer in this survey.

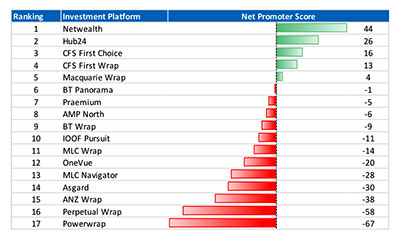

Netwealth was the favoured administration platform for investment functionality, with Hub24, CFS FirstChoice, CFS FirstWrap and Macquarie Wrap rounding out the top five of 17.

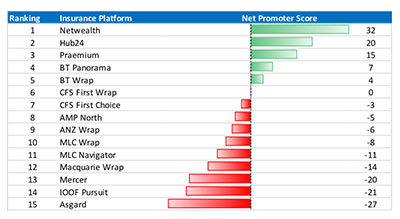

Netwealth was also the favoured platform for insurance functionality, with Hub24, Praemium, BT Panorama and BT Wrap rounding out the top five of 15.

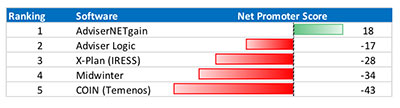

AdviserNETgain was found to have the most satisfied advisers in the financial planning software space, although it was on limited licensee coverage.

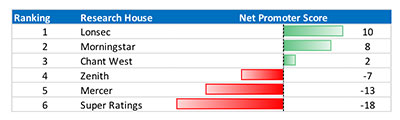

Lonsec edged out Morningstar for the most satisfied advisers in the research space, according to Adviser Ratings.

There was an extraordinary movement of advisers between licensees in the last three years, especially out of the institutional space, with a 43 percent increase in the number of small licensees.

“The challenge is understanding where advisers are going and servicing a greater volume of advice firms,” Mr Woods said. “It is not just about building a better technology solution but strengthening relationships with key decision makers in these practices who are increasingly looking for ‘plug-and-play’ software choices.

“AMP and the banks could often afford to have technology support staff on the ground, resulting in a ‘sticky’ adviser for the incumbent technology providers. There are now over 8000 practices in Australia with less than five advisers, so it is just not feasible to have this support model in place” Mr Woods said.

In assessing satisfaction levels of advisers, Adviser Ratings used a widely-known customer experience metric, the Net Promoter Score (NPS). NPS measures the loyalty of a user to a particular provider’s product or service.

Other qualitative questions were overlaid, including fees, provider support, adviser reporting, platform functionality, robustness of research and ease of use to help understand the reasoning behind these scores.

“With most providers where functionality or features were fairly even, we found the level of service and knowledge and helpfulness of its staff, was the most important feature when coming up with their score,” Mr Woods said. “We then split these responses by licensee and geographic area to determine which type of advisers are better serviced.”

With Adviser Ratings forecasting a significant acceleration of adviser movements and a continued shift into self-licensing, it opens the door to new players.

“With satisfaction and loyalty rates at such low levels and with advisers moving to practices where technology providers don’t have a strong influencing relationship, incoming players like Intelliflo and Advice Intelligence will present a real challenge to the market leaders, IRESS and Temenos,” Mr Woods said.

“We are seeing this in the $800 billion platform space with the emergence of Netwealth and Hub 24. Swiss-based Avaloq recently announced its intention to tackle this area. Frustrated advisers will soon have more choice. It is up to the incumbents to see if they are ready for the challenge.”

The Financial Advice Landscape report is said to be the most comprehensive snapshot of the financial advice industry and provides a unique view of the advice ecosystem in 59 regions across Australia. The report incorporates Adviser Ratings’ proprietary data, census data, and results from an online survey conducted in Nov-Dec 2017 responded to by 1,103 financial advisers.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?