Fear, anxiety constricts firms – Uni Syd research

AMBITIOUS corporate incentive schemes and performance goals can cause anxious employees to lie about results – and this has a negative impact on productivity, according to University of Sydney Business School research.

Professor of accounting, Wai Fong Chua used the example of the Finnish multinational, Nokia, which suffered financially because of the fear that it generated amongst middle and senior managers.

“Shared fear was so strong amongst Nokia’s middle managers that they withheld important information about the viability of its technology from senior managers,” Prof. Chua said. “The company suffered significant losses as a result and was forced to exit the smartphone market.”

Prof. Chua’s own research relating to the Australian subsidiary of a global computer company has confirmed the need to better understand ‘affective technologies’. These she described as processes, information systems, and performance/financial goals that “have an emotional impact and economic consequences”..

“Take, for example, a billion dollar revenue target that is to be achieved within 18 months,” Prof Chua said. “This tends to produce an affective outcome.

“It could be anxiety, it could be fear, it could be excitement, it could be all of these things and that, in turn, affects the way people work in an organisation.

“I believe there is considerable fear and anxiety in today’s corporations, especially those experiencing financial challenges. When corporate distress is not well handled it can have quite adverse consequences.”

Explaining her interest in ‘affective technologies’, Prof. Chua said financial managers today played a key role in designing performance management systems.

“We’re fundamentally interested in ensuring that the systems we design and the goals that are set enable people to develop their potential and achieve to the best of their ability,” Prof. Chua said.

“Stretch goals can motivate staff. But, when tied to incentive schemes that operate in unsupportive corporate cultures, this can prompt fraud.”

For example, she said, investigations were continuing into the incentive schemes at the Wells Fargo bank in the United States, where about 5000 employees were thought to have created fictitious customers in order to meet or exceed their performance goals.

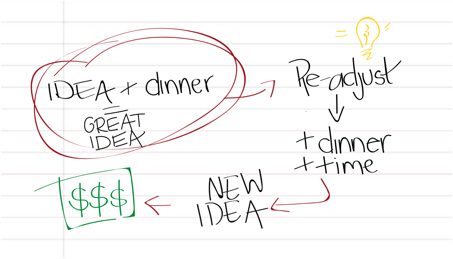

While researching affective technologies, Prof. Chua has also looked specifically at innovative start-ups and the relationship between entrepreneurs and investors.

“When passionate entrepreneurs, who are really keen on developing their product, turn to venture capitalists, the focus of their project may change in an unwelcome manner,” she said. “Investors are generally interested in earning a quick rate of return and their shorter-term focus may differ significantly from the passion of entrepreneurs.”

Prof. Chua said companies “need to be aware of levels of anxiety and fear and enable folks to discuss processes and goals without being so afraid that they fabricate an answer”.

“Organisations are emotional arenas, not just economic entities,” she said.

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?