HIA says policy changes seeing a spike in home building

THE Housing Industry Association (HIA) is observing a spike in new home building that seems to be a result of recent policy changes in several areas both financial and governmental.

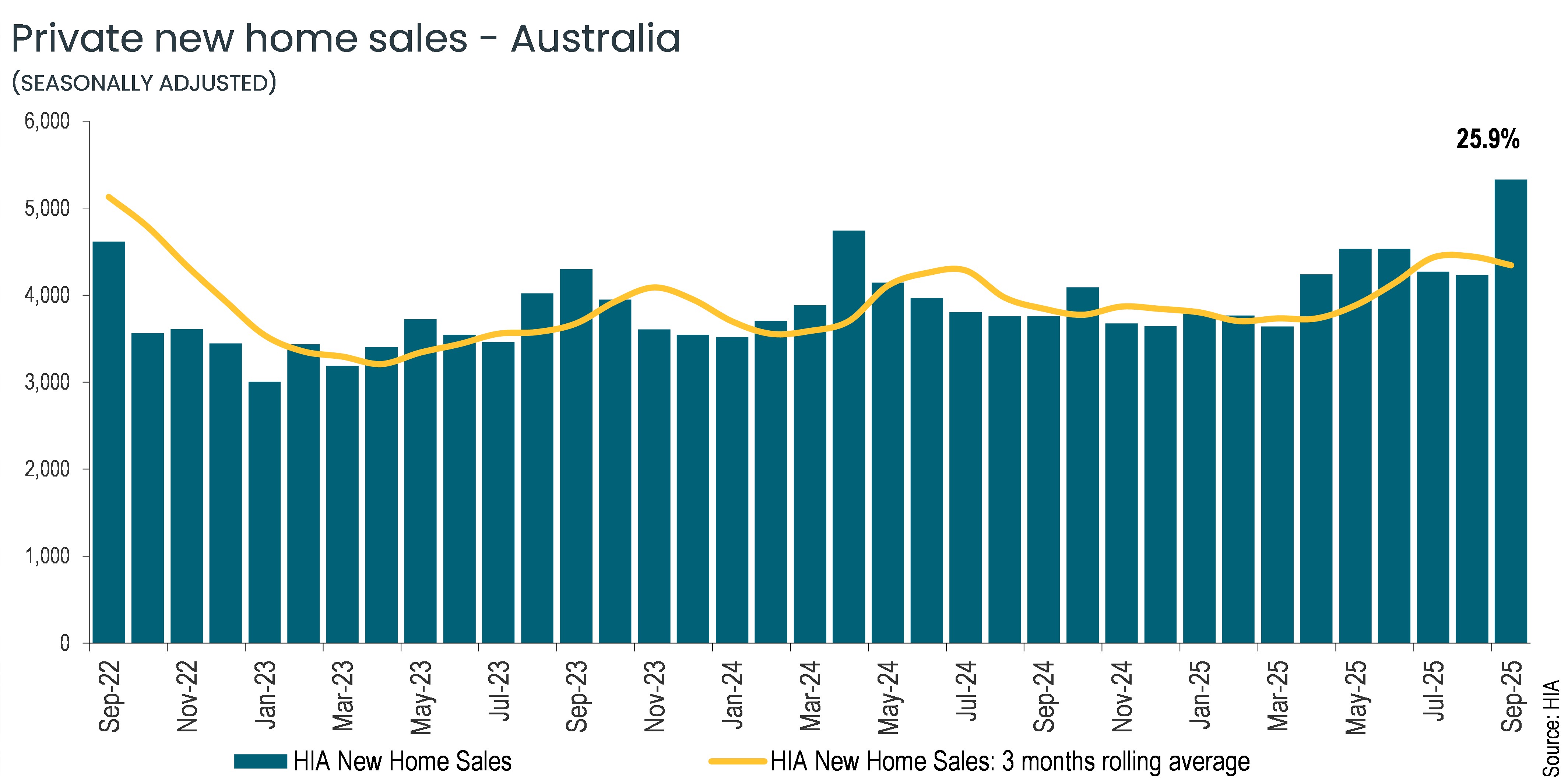

“Sales of new homes for construction jumped 25.9% in September following a series of policy changes, including a cut to the cash rate in August, removal of Lenders Mortgage Insurance and easing in planning restrictions,” HIA chief economist, Tim Reardon said.

The HIA New Home Sales report is a monthly survey of the largest volume home builders in the five largest states and is a leading indicator of future detached home construction.

“The volume of new homes sold nationally increased by 25.9% in the month of September 2025. This is the largest monthly increase since the final phase of the HomeBuilder grant in March 2021,” Mr Reardon said.

“This sees sales in the September quarter a more modest 4% higher, to reach its highest quarterly volumes since October 2022.

“Sales of new homes in September were notably stronger in New South Wales and Victoria where sales have previously struggled to recover despite the cut to the cash rate. These markets have been very slow to respond to the cuts to the cash rate.

“The rise in sales in New South Wales and Victoria could be a sign that new home building is returning to more average levels, but further data will be necessary to support this view,” Mr Reardon said.

“The cut to the cash rate is the primary driver of the rise in sales of new home this year. Other factors include low unemployment, strong population growth and rising established home prices.

“The rise in established home prices is seeing more households choosing to build a new home, because it is cheaper than an established home.

“The removal of the requirement for LMI for first home buyers has seen builders across the country report increased first home buyer activity.” He said.

“Lowering the cost of borrowing is expected to see an increase in new home building, and therefore have a positive impact on the supply of homes. Because this policy change doesn’t impact the amount a first home buyer can borrow, it doesn’t add to their risk of default.

“Around a third of all new homes are built by first home buyers and they play an important role in increasing housing supply.

“The announcement is likely to have seen more confidence in the market outlook for all households, not just first home buyers.

“Additional policy reforms including accelerated approvals processes in New South Wales through complying development pathways (CDCs) and lower infrastructure costs appear to be having a positive impact on supply.

“Further reforms to fast-track approvals as well as accelerated Environment Protection and Biodiversity Conservation (EPBC) decisions and further planning reforms could further increase supply.

“Australia will likely fall well short of the goal of 1.2 million new homes, but policy levers are starting to move in the right direction in many states,” Mr Reardon said.

This month’s increase in new home sales nationally was driven by all states, led by a 34.8% increase in Victoria.

New South Wales trailed closely behind with a 34.4% monthly increase, followed by Queensland (+25%), Western Australia (+14.2%) and South Australia (+7.5%).

ends

How to resolve AdBlock issue?

How to resolve AdBlock issue?