Peppermint: a taste of mobile banking going global

EXTRA >>

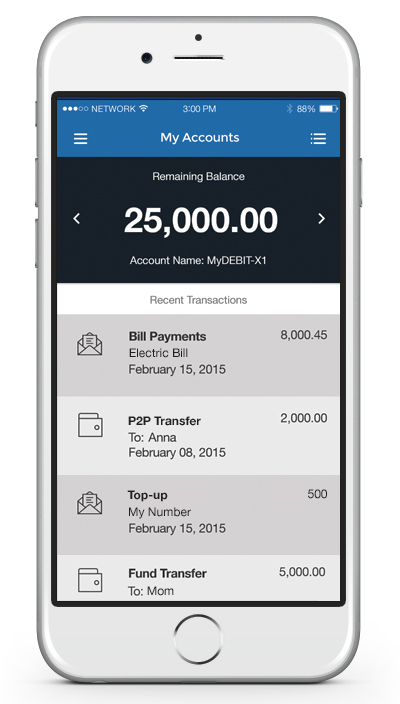

PEPPERMINT Innovation Ltd, an Australian-developed mobile banking technology platform, is aiming to offer access to banking services for millions of people not currently linked to traditional banks.

Working with a network of about 70,000 agents to promote and introduce its platform into the Philippines, Peppermint is believed to be poised for rapid expansion over the next few years. Australian investors have shown strong early support for the business.

Following a successful $3.87 million capital raise in October, and subject to meeting the Australian Securites Exchange’s (ASX) other pre-quotation conditions for listing, Peppermint Innovation Ltd will look to list on the ASX via a reverse takeover of Chrysalis Resources Limited (ASX:CYS).

The listing will give investors access to Peppermint’s innovative platform and an opportunity to be part of the mobile banking payment ‘revolution’ according to Peppermint Innovation’s managing director, Chris Kain.

Peppermint is based in Perth. It operates an established proprietary mobile banking, payments and remittance technology, which aims to eventually provide secure mobile financial services to anyone, anywhere in the world.

Mr Kain said the aim was to drive financial inclusion – opening up banking services, including payment services, to those without access to a traditional bank.

Currently, the Peppermint Platform is deployed in the Philippines as part of the company’s focus on transactions in the developing world.

The Philippines is an emerging market with a population of approximately 100 million people. Filipino economic migrants who move to major centres or overseas looking for work rely on remittance services to send money to their dependents.

Peppermint research shows up to 75 percent of the population are ‘unbanked’, and with almost 114 million mobile phones in use, the Peppermint platform capitalises on this large market opportunity.

Peppermint’s technology is employed commercially by three of the top Filipino commercial banks, generating around one million transactions every month. Revenue is derived through commission on each user transaction and fees for the development and maintenance of the Peppermint platform for commercial clients.

“We are delighted with the strong support we've received from existing shareholders and the response of new investors to our public offer.,” Mr Kain said.

“We are confident that the Peppermint platform will have a strong uptake beyond existing customers in the Philippines, providing a wide range of financial services via a mobile phone to unbanked populations there.

“It is estimated that about 2.5 billion adults worldwide lack access to basic formal financial services and our platform will help promote financial inclusion to a large part of the global unbanked population.

“We see this as a significant opportunity to add value and retain growth potential for the company.”

He said Peppermint’s commercial growth had been largely de-risked by the work done with existing clients and a well-established customer base in the Philippines where US$9.5 million has been spent developing the technology.

The key members of the development team, who are now incentivised members of Peppermint Innovation, were previously instrumental in the development of the Globe Telecoms’ GCash mobile remittance platform.

Peppermint has also partnered with MyWeps/1BRO Global Inc. in the Philippines to develop a mobile remittance service ‘Powered by Peppermint’ to capture transactional flow currently outside of the traditional banking system.

As part of this partnership, Peppermint will also be provide the functionality for MyWeps/1BRO Global to address other domestic payment services in the greater domestic person-to-person market, which comprises domestic remittances, paying bills and loan payments.

A study commissioned by the Bill and Melinda Gates Foundation from Bankable Frontier Associates in 2010 estimated this market to be valued at US$3.2 billion per month from 45 million transactions conducted per month in 2010.

While there are already other players in the sector, the market is large enough to support additional platforms as there are still large numbers of remittances transferred via more expensive methods, Mr Kain said.

1BRO Global Inc. has about 70,000 agents and 40 business centres spread out over the country, which will help drive adoption of the Peppermint mobile remittance platform.

The funds raised from the public offer will be used to accelerate the roll out of the ‘Peppermint Platform’ and expand its reach throughout Asia, Europe and the rest of the world.

Peppermint offered 193,465,000 shares at an issue price of $0.02 per share to raise the funds. The public offer was managed by lead manager, DJ Carmichael and was made under a prospectus dated October 16, 2015. All offers under the Prospectus are now closed.

ends

Ends