Warnings on tech. sector values: InterFinancial

MERGERS and acquisitions specialists InterFinancial have identified a concerning trend for investors in technology companies – the decline in the value of software-as-a-service (SaaS) financial model companies.

“One of InterFinancial’s sector specialties is ICT so we follow trends in technology fairly closely,” managing director Sharon Doyle wrote in a recent report. “One trend that we have noticed in the US-listed technology stocks is a decline in valuations for SaaS.”

Ms Doyle said there may be a window of opportunity for Australian technology businesses to sell sooner rather than later, “before the trends from the US market catch up”.

“SaaS software is sold via a subscription model where users ‘opt-out’ versus the traditional licence model that is sold via annual renewals and users are instead ‘opting-in’. This leads to a substantial difference in the model for consumer engagement and creates a higher level of stickiness and thus recurring revenue,” Ms Doyle said.

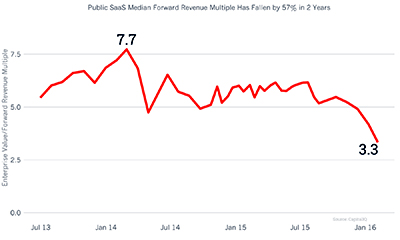

“The forward revenue multiple for public SaaS companies in the US has dropped by 57 percent in two years. While the market was sitting at its frothy highs of 7.7-times revenue in early 2014, it then levelled off to 5-6-times revenue in 2015, and a steep decline to 3.3-times in recent months.

“This got us thinking – is the Australian market for technology experiencing a similar impact? Admittedly the markets are different, and Australian investors are significantly behind the US in the shift in investment to technology, especially early-stage,” Ms Doyle said.

“But does the US market indicate what we might see in the Australian market?

“We analysed the revenue multiples of ‘established technology companies’ against ‘emerging technology companies’ and noted that over the past 12 months, there has not been a decline in valuation multiples in Australia.

“In fact there have been slight improvements and Australian multiples are now consistent with those listed technology companies in the US.”

One of the factors InterFinancial considers when performing a valuation is the quality and strength of the future cash flows. The data revealed that the emerging technology companies, as anticipated, are still in steep growth mode.

“Typically for companies in a similar basket we would see higher valuation multiples for those companies with a higher revenue growth forecast,” Ms Doyle said. “However, another influencing factor is the quality of future cash flows, which are typically stronger with more established businesses that have diversity in revenue streams – thus mitigating risks from any revenue concentration.

“So despite the lower growth forecast for the established technology companies, they are showing a higher average revenue multiple.”

“Our history at InterFinancial tells us that the trends we see in our own business activity are not reflective of the public equity markets. We primarily assist privately-owned businesses and there is always activity in those businesses with solid fundamentals, regardless of the state of the market reported on the front pages of newspapers.

“We are currently seeing good deal flow despite the fluctuations in the global stock markets and ensuing negative reporting in the financial press.”

www.interfinancial.com.au

ends