Innovation Series: Hit or miss? Australia’s great biotech opportunity

EXTRA >> By Mike Sullivan

THE OPPORTUNITY for Australia’s remarkable medical and bio-technology capability is vast – and the opportunity-cost is remarkably low – as outlined at the final Innovation series event for 2015 in Brisbane.

That’s because the cost of developing Australia’s capability has largely already been covered already through decades of government-sponsored research in universities throughout the country and Australia’s scientific research agency, CSIRO. But the risk is that Australia may miss out, especially in the dynamic Asian markets, because the country has consistently let itself down by not translating that research into production and national economic benefit.

Both sides of the equation were explained by Australians at the cutting edge of biotechnology at the Innovation Series event. Chris Nave, the founding partner of Brandon Capital and Partners and principal executive of the Medical Research Commercialisation Fund (MRCF), warned that the window of opportunity is open for Australia – but “we have to act now or it will close” and a vast economic opportunity will go begging.

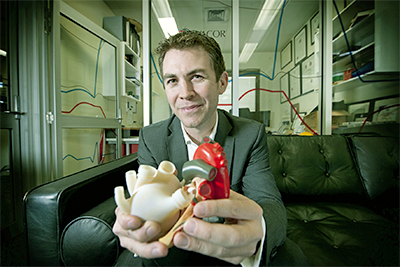

He gave as a ready example the other speaker at the event, Daniel Timms, the chief executive officer and chief technical officer of BiVACOR – the collaborative company that has created the first device that replaces the entire human heart. With assistance from Japanese and German engineering teams, and lately the world’s leading heart replacement research organisation, the Texas Heart Institute in Houston, Brisbane-based Dr Timms’ invention will soon undergo human trials after multiple successful heart replacements on cows and sheep.

Dr Nave is critical of Australia’s past record, across the board, in translating ground breaking research into innovative economic activity. That was why he created the MRCF in the first place – and he did it by goading universities, investors and governments into a collaborative net that translated ideas into action. In fact, Dr Nave was one of the key advisors to the Prime Minister’s Department in shaping the recently announced National Innovation and Science Agenda (NISA).

Dr Nave’s opinions must have featured strongly in the government’s considerations, especially as the MRCF has the runs on the board to show for its collaborative approach.

“It buoys me that they are prepared to listen and I think they are taking our advice,” Dr Nave said. He said the goal of the MRCF, which is now onto its third fund, is to identify and assist suitable research to become the next Cochlear, CSL or ResMed.

He describes that process as helping medial start-ups to fail fast while identifying those that do have a future then placing financial and business support behind them to achieve success.

MRCF has grown from strength to strength on the back of its already strong success stories and financial returns for investors but that has required a huge education process for investment markets in this sector.

“The exits achieved by Fibrotech and Spinifex and Hatchtech, all within the last 12 months, have certainly given the industry a shot in the arm,” Dr Nave said. “They have proven that we can actually do it. They are all home-grown technologies started within the university or medical research sector, grown up here and they achieved exists that were internationally significant.”

Dr Nave said the bio-medical sector was already one of Australia’s most significant economic sectors – and a far greater employer than industries auch as mining.

“Our services industry makes up the bulk of employment in Australia,” Dr Nave said. “But unlike London, where London is a services industry to the rest of Europe, Australia is a service industry to itself.

“So if we don’t create new industry and we aren’t creating new economies, our service industry, with the exception of tourism, will start to decline. So we need to find new ways to engage our lawyers and our bankers … so we can continue to grow the economy.”

Dr Nave said it was clear that Australia had been frittering away its strong research capability by not translating that capability into product development and jobs.

“Australia is actually ranked number four in the world for its biotechnology capability – and that is not per-capita adjusted,” he said. “We stand on our own as number four in the world. 2015 is the second year in a row we have had this ranking – and that takes into account our workforce, our infrastructure and also our performance.”

“However, Australia is really poor at translating research and innovation into economic development,” Dr Nave said.

The annual Industrial Skills Enhancement Programme (INSEP) Global Innovation Index ranked Australia 10th in 2015. Dr Nave said while Australia always ranks highly in terms of its innovation input – that’s the quality of our university systems, the education of our population and how good we are at supporting the research endeavour in Australia – when evaluating innovation output, Australia drops to 24.

“And this is the best we have scored for about the last six years,” Dr Nave said. “Innovation output is the amount of new innovation that is created by that input. So that’s not too bad.

“But where it is really damning is if we look at the Innovation Efficiency Index ... we actually rank number 72 out of 141 countries – and this is actually the best that we have performed for five years.

“What all that means is that we have the infrastructure and the capability to do the research and we are actually really good at doing it – we come up with lots of great ideas – but then we are one of the worst in the world at turning those ideas into jobs and income for the country. It is something we need to fix.”

INNOVATION URGENCY

Dr Nave presented some disturbing statistics about Australian innovation that help to put the government’s NISA approach in context. They also explain the impetus behind the MRCF and the reasons why diversification is bringing early success.

Of the top 50 stocks on the ASX 200, by revenue, 61 percent of the earnings are generated by two industries – resources and banking – and 60 percent of those earnings are generated by just 10 companies alone.

Australia’s four major banks and two mining companies actually account for almost half the revenue of Australia’s entire stock exchange.

“For those of us here who are CEOs of companies, I know from my company’s perspective, if I had such a concentration of exposure, I’d get fired,” Dr Nave said. “As a country, this is dreadful sector diversification.”

Dr Nave also showed evidence over the past 50 years of job creation in Australia.

“Manufacturing made up a big part of our workforce in the 60s, and that has just gradually declined through to now where we have very little bedrock manufacturing left,” Dr Nave said.

“What I think is striking is that mining has always been a small employer. There is a little blip there through 2010, 11 and 12 at the peak of the mining boom, where mining got about 1.8 percent of all jobs. So mining generated great income for us, but it actually doesn’t employ people.”

He believed the creation of these anomalies stemmed back to Federal Budget allocations, which stem from an outdated mindset on innovation.

“Back in 2012/13, Australia spent $8.37 billion on research (Federal Budget figures),” Dr Nave said. “We had a look at what they spend, in the Budget tables, on anything to do with (commercial) translation. It is a blip on the bottom of that chart.

“The Budget included support for the automotive industries in translation, so if you remove the automotive support, the support for translation is really small.

“So it is no wonder that we rank so highly across the globe in terms of coming up with new patents and new inventions and novel outcomes, but really poorly at translation. Because there is no funding there to help take it from the laboratory through to a product. That is what we see as the real gap, or the opportunity, however you want to view it.”

Dr Nave said medicinal and pharmaceutical products are Australia’s largest manufactured industry today.

“They employ over 40,000 people and they actually surpassed the car industry in around about 2007/8,” he said. “The reason why this is such a strong industry, and it is also growing at around about 12 percent per annum – and you will notice that it grew throughout the GFC without a blip – and it’s because it is an industry that is protected by patents and a really stringent regulatory environment.

“Unlike the car industry, where we got into a race to the bottom on cost, this is an industry in which cost actually doesn’t matter quite so much. It is actually about quality and meeting the stringent regulatory guidelines you need to meet,” Dr Nave said.

“So, for me it is one industry where Australia really should be backing its capability. It is an industry that can afford to pay the salaries that we expect.”

FUNDING THE FUTURE

Those facts underpin the MRCF, whose third funding round is described by Dr Nave as a “paradigm shift” for Australian nnovation.

“The raising of our new fund, $200 million in the MRCF Fund 3, is also significant,” he said. “It is the largest life sciences fund raised in Australian history. But more importantly, it was raised exclusively from superannuation funds.

“A big problem for our country has been our almost $3 trillion superannuation industry has run as far away as they can from innovation, even though they recognise that the future economy has to rely on it. So I hope that our new fund proves to be a bellweather and it will lead to other funds.”

The signs are good, with Uniseed and the Gof8 currently planning new innovation funds, while another group is looking at a listed fund. CSIRO has just announced an early-stage company innovation fund.

“Successful biotech, basically, is just manufacturing,” Dr Nave said. “When we talk to government, we try to get them away from the idea that biotech is about lab coats and test tubes. Because, at the end of the day, if you develop a new drug or a new medical device, it just becomes smart manufacturing.”

Biotech has performed well.

“Cochlear is now a $4.9 billion company,” Dr Nave said. “It is still based here, in Australia, manufacturing from here. In fact it just built a big new plant in NSW.

“But it’s telling that Cochlear had to have many years of government support and it had to do telethons to get enough funding to actually get them through to commercialisation. I think this is where the real gap exists in Australia.”

And this is where the MRCF comes in. Dr Nave said Australia is up against huge R&D spending in the US and, lately, China.

“Current estimates are that China will surpass the US in terms of government expenditure on research in about 2019,” he said. “It will be the largest funder of R&D.

“What’s telling at the moment is that a big proportion of Chinese expenditure on R&D is on development. They do less exploratory research and focus on trying to improve products that they have already got.

“Most of the R&D at the moment is actually coming from business in China. They are investing heavily trying to improve what they already do.

“China does not yet have that bedrock of exploratory R&D excellence, which Australia has built up over the last 100-150 years. I think we still have the opportunity to capitalise on what we have created, but I think the window is slowly shutting.

“Our opportunity is that the next region for biotech is right on our doorstep – and it is not just China.”

In terms of spend per capita on healthcare by government, the US is way out in front on $8800 per person, while in Australia it is at $4000. Indonesia, India, China, and the Philippines – all large population countries – and very low at present, but Australia only needs to extrapolate the South Korea experience to see where its future lies in the sector.

“Korea is a great illustration,” Dr Nave said. “Their expenditure, per capita, has grown over 300 percent, 10 percent per annum, over the last 11 years. That is in the period Korea has gone from a developing nation to a developed nation.

“This is exactly what is going to happen with India and China and this is a great opportunity that we are not yet capitalising on, for us to be there translation our healthcare services our clinical services and also our biotech capability.

“You have to have your pulse checked if this doesn’t give you cause for strident optimism,” Dr Nae said. “I think we are in for exciting times ahead.”

BIVACOR ON THE PULSE

One of Australia’s brightest lights in biotech design and manufacturing is reason alone for the sector’s pulse to rise at its prospects – although ironically the device is an artificial heart that has no pulse. But they plan to engineer a pulse sensation in, if only for patient piece of mind.

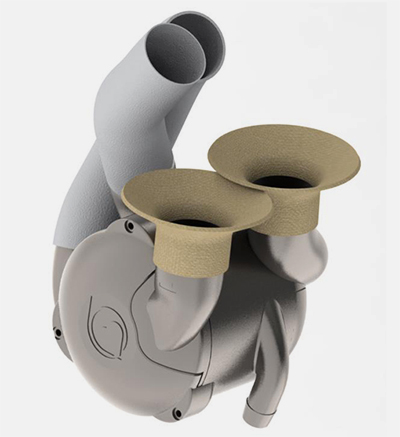

BiVACOR is a quantum leap in heart replacement – a device that operates under its own battery power for about 10 years and only has one moving part that does not wear out – some hail it as an improvement on nature itself.

BiVACOR is a small titanium pump, based on a rotor with impeller blades n either side. turning effortlessly in a magnetic field, to move blood in direct reaction to physiological needs. Up until now medical devices have only been able to replace the left ventricle of the heart – and no device has been small enough to effectively be fitted to women and children.

It is reported that about 17 million people a year die of heart failure – so there is no question about BiVACOR’s market or its significance.

Daniel Timms explained his motivation for creating a viable heart replacement device, and it was a lot more personal than that. His father died of heart failure in Brisbane just a few years ago and Dr Timms had been working day and night for many years to try to perfect the BiVACOR device to help save his father before it was too late.

He knows it was the influence of his father, Gary – a plumber with an extremely inventive mind – that got him started on the quest in the first place.

In the early days, his father helped him to create test beds that emulated the human circulatory system – in fact Dr Timms recounts going to Bunnings to buy pipes, hoses and connecting parts, where the planned plastic ‘human bloodstream’ would be laid out on the floor. Dr Timms believes his years of helping his father solve plumbing problems directly influenced his creation of the BiVACOR and certainly encouraged him to pursue a PhD in engineering at the Queensland University of Technology to perfect it.

Dr Timms said the artificial heart has been a lot like the story of flight. At first inventors tried to emulate the natural style of birds, many being killed trying to fly flapping feathered wings. Technology improved on nature. In flight today, the most effective power source is the turbine engine – and, as it turns out, that is similarly true for artificial hearts.

Dr Timms’ master stroke was to realise that the mechanical and electrical pumping systems being developed were prone to failure as their components wore out. His ‘turbine’ approach has just one moving part, a lightweight, specially shaped two-sided impeller, suspended in a magnetic field. Each side of that impeller feeds a different side of the heart – but the genius is that each side talks to the other to automatically meets current physiological needs.

“It’s fully implantable – with left and right circulations and they talk to each other,” Dr Timms said.

Unlike the current state-of-the-art AbioCor heart replacement – which was developed at the Texas Heart Institute, which is now partnering BiVACOR’s research and testing – BiVACOR does not need external power sources and it has about double the outflow of the AbioCor.

After many successful trials on cows at the Texas Heart Institute, Dr Timms said the most gratifying breakthrough so far in proving BiVACOR was the transplant into a sheep, performed at the partnering Prince Charles Hospital in Brisbane. It was this hospital the supported Dr Timms throughout his early challenging years in developing the BiVACOR system.

In fact, the impeller system itself was developed in Brisbane, with the help of QMI Solutions’ 3D prototyping printer. Dr Timms developed collaborative partnerships in Japan, German and South Korea to develop the componentry, assembly and connection systems, receiving support from the Heart Foundation throughout.

Construction giant Baulderstone fitted out the Prince Charles Hospital lab where the BiVACOR transplant into a sheep was successful.

Dr Timms said the biggest production breakthrough came when the world-leading heart surgeons of the Texas Heart Institute invited him to develop BiVACOR in collaboration and the work is now centred in Houston, Texas, with the international office in Brisbane.

There he has developed the titanium device in alliance with some of the great names in heart surgery and artificial heart development: US doctors Billy Cohn, Bud Frasier and Denton Cooley, along with Australian Prince Charles Hospital heart specialist John Fraser.

Recent developments in 3D printing have also been a godsend, Dr Timms said.

“We can iterate, iterate, iterate,” he said, “and can recreate.” It helps explain why Dr Timms has made such rapid recent progress, having embarked on the quest to create an effective artificial heart almost 15 years ago.

He explains it as: Clinicians say “we can’t do that”. Engineers say “that’s a challenge”.

Dr Timms said manufacturing of the initial versions is currently being explored and he hopes the final versions of the device will be available for humans in about three years time. He is also pleased he has been able to protect and retain the intellectual property, throughout discussions.

A small, light, self-powered artificial heart that meets the average person’s needs of 12,000 beats per day, or 42 million a year, and 12 litres per minute, sounds like a biotech dream.

It was a dream for Dr Daniel Timms – one he made come true.

ends