Global economies ripe for media M&A splurge

MAJOR media and entertainment companies around the world are gearing up for an unprecedented splurge in merger and acquisition (M&A) activity, in a business climate that is ripe for it, according to research from EY.

EY’s 12th Global Capital Confidence Barometer indicated the pursuit of acquisitions by major media and entertainment groups would accelerate to the highest levels in many years, as company leaders get beyond short-term tactical challenges to focus on long-term strategic opportunities.

The report also shows media and entertainment (M&E) executives have heightened their focus on “structural industry challenges resulting from digital transformation”. EY’s latest Global Capital Confidence Barometer covered more than 1,600 senior executives, of which 70 were from M&E companies, in more than 60 countries.

Confidence in the global economy among the world’s leading M&E companies is at its highest point since the global financial crisis (GFC). This wave of confidence is fuelling their deal pipelines and creating an expected record number of mergers and acquisitions, according to EY.

EY Global Media and Entertainment Transaction Advisory Services leader Tom Connolly said, “Media and entertainment companies have set their sights on aggressive growth both organically and through mergers and acquisitions. Companies are looking for deals that will both complement and enhance their digital capabilities.

“More than $10 billion of deals are projected and the number of executives expecting to make an acquisition during the next year has more than doubled, indicating not only confidence in the economy but an enthusiasm for the future.”

Mr Connolly said when asked their perspective on the state of the global economy, an overwhelming 77 percent of executives surveyed said it was improving, with 21 percent indicating it is stable and only 2 percent that it is declining. This is a significantly better outlook from six months ago when only 52 percent of executives said the global economy was improving, 45 percent that it was stable and 3 percent that it was declining.

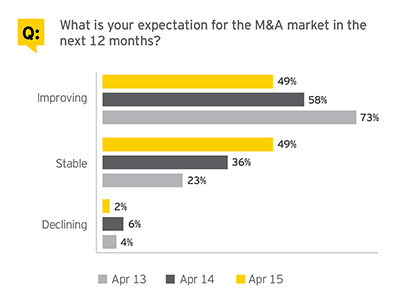

A vast majority of executives see the global M&A market remaining strong for the remainder of the year with 96 percent indicating it will either improve or remain stable and only 4 percent that it will decline.

Half of all respondents expect to actively pursue acquisitions in the next 12 months, compared with less than half of that (23%) two years ago.

Companies have meaningful deal pipelines, with 29 percent indicating they have five or more deals in their pipeline right now and 60 percent of respondents expect their number of deals to increase during the next 12 months.

Mr Connolly said, additionally, long-term opportunities from ongoing growth resulting from global digital media adoption, combined with overwhelming confidence in the economy, are driving a significant increase in the number of deals in the pipeline and companies’ intentions to invest.

The top markets in which companies will be most likely to invest are China, the United Kingdom, the Netherlands, Australia and the United States .

The report is a survey of senior executives from large media and entertainment companies around the world that gauges corporate confidence in the economy, identifies boardroom trends and provides insight into companies’ capital agenda.

ends